School Surety Bond Claims Guide

Estimated Read Time: 5 minutes12-17-2021

A surety bond may be required for certain types of schools as protection against a loss of tuition from the school’s misconduct, fraud, or other failure to provide education. Protection may be provided for damages to regulators. The following types of education businesses in various states may have a surety bond requirement:

- Driving Schools (commercial or individual driver licenses)

- Driver Testing Sites

- Private Schools

- Cosmetology/Barber Schools

- Dance Studios

- Trade Schools

- Real Estate Schools

Jet Insurance Company as the surety bond provider gives peace of mind to both the State regulator (referred to as the “obligee” in Surety language) and the school owner.

How, you ask? By issuing the bond, Jet provides a guarantee to the obligee that affected students will be compensated in case the operator fails to refund costs, even if bankruptcy is filed by the school in most cases. And for school owners that choose Jet, our team will always defend you against bogus claims.

Why Are School Bonds Needed?

The main objective of School Bonds is to guarantee the refund of tuition for incomplete education due to a school shutting down. The State agency regulating the school may suspend or revoke the school’s license for misconduct or fraudulent behavior and, in turn, the school’s ability to provide education for which tuition has been paid. Another reason for a school shutting down and leaving its students with an incomplete education is that the school is forced to close for financial reasons, like running out of funds.

In many cases, claims against the School Bond can be prevented simply by the school refunding its students for any unused tuition. If the school does not provide reimbursement, the affected students can file for a claim on the surety bond to get the refund they were owed.

Some instances of bond claims may actually come from the obligee that regulates the schools. Examples of what might constitute a bond claim are the school’s failure to pay administrative or legal costs to the obligee.

Lastly, a student can file a claim on the bond if education was provided, but was not to a minimal standard. For example, a barber school provided an education so inadequate that the graduate could not even perform a buzz cut.

When Can a Claim Be Filed?

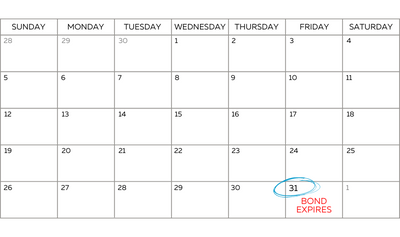

Unless otherwise specified on the bond form or in legislation, School Bonds are limited to the filing of claims during the bond’s active period or within the cancellation period. One such specification can be found on the Florida Third Party Driving Exam Administrator Bond; claims, actions, suits, or proceedings can be brought against the bond within a year from the bond’s expiration or termination date.

Bonds typically have a cancellation period of 30-60 days before the obligee releases the surety and the school operator from liability. Infractions caused during this period can have a claim made upon them.

Claims Not to Exceed Bond Limit

Claims on a School Bond cannot exceed the bond limit that is set by the obligee. The limits will always be in an amount that would cover the cost of refunding tuition following the school’s closure. Some School Bonds will have a custom limit to ensure the amount is sufficient, while others will have a set limit that can range from as little as $1,000 (like the Michigan Cosmetology Apprenticeship Bond) or even as high as $200,000 (like the previously mentioned Florida Third Party Driving Exam Administrator Bond).

Process for a School Bond Claim

The school is obligated to refund their students for the incomplete education, like in the case of a school closure after tuitions have been collected. Typically, the school will have a brief period of time to complete the refund. Failure to reimburse the affected students will result in the students seeking compensation through disciplinary action.

The first step are complaints making their way to the obligee, which will prompt an investigation into the complaint. If the obligee finds the complaint to be legitimate, corrective action will be demanded for the school (or former school) to make.

If the school doesn’t provide the compensation as commanded, action can be taken on the School Bond for reimbursement. Once a claim is filed, Jet will look into the evidence presented before paying out the claim to see if there is any malfeasance or false claims. Any evidence the school has in its defense should be submitted to Jet. However, if the claim holds up, Jet will fulfill the terms of the School Bond and provide reimbursement to the affected students (or the obligee, if applicable).

The nature of a surety bond is different from your average insurance policy following a claim payout in one key area—the surety company is repaid by the principal—so the school will be obligated to pay Jet Insurance Company back the amount of the claim payout.

Claim Example

As an example of the claims process, let’s take a look at the Oregon Driving School Bond. The operator of A to Z Driving School (a fictitious school used for our example) ran out of funds and could no longer keep the business going. On the school’s closure, the school would need to pay back any prepaid tuition and fees for education not provided.

If the operator doesn’t refund the students in agreement with the Oregon Revised Statutes, then the students will file a complaint with the Oregon Driver and Motor Vehicle Services (DMV). The DMV will investigate complaints and prescribe corrective action, like fulfilling the refund. If the operator fails to do so, the student (or students) can seek reimbursement from the bond.

Once a bond claim has been filed, Jet will review the claim and all available evidence provided by the students (or their attorneys). Jet reviews the claims, recognizes the validity, and pays the claimants. A to Z Driving School still wants to operate due to an uptick in driver demand. The school pays Jet back for the bond claim, obtains a new bond, and returns to business.