Wisconsin Auto Dealer Bond

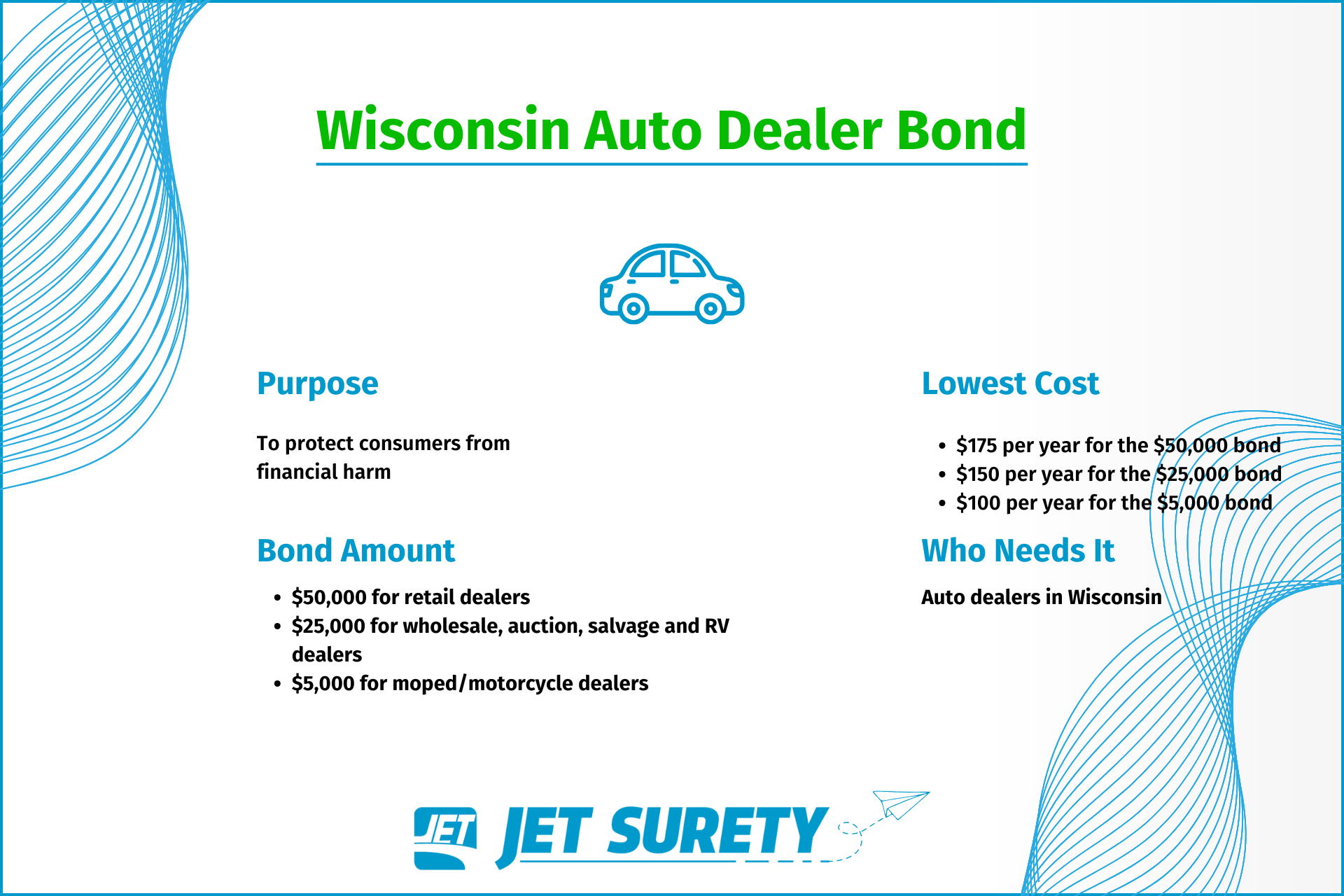

Motor vehicle dealers licensed in Wisconsin must file a surety bond with the Department of Transportation, Dealers Section. The Dealer Bond ensures the public is compensated should they experience financial hardship at the hand of a licensed Wisconsin dealer.

Complete the below application and get your bond in minutes.

Jet studies the car business to sniff out the shady shops that cause all of the claims, allowing us to lower bond prices for Wisconsin dealers.

Other bond providers just run a generic credit check, which opens the floodgates causing quality dealers to unfairly subsidize the deadbeats with an inflated premium.

We think honest dealers with solid business practices should get to save on their bond.

We also provide dealers direct access to surety underwriters and claims handlers without any agents or brokers in the middle. Eliminating the middleman dramatically simplifies the bond purchase and filing process with the lowest rates, no down payment, a no-obligation monthly payment option, and the best defense should anyone ever make a claim on your bond.

How Much Does a Wisconsin Dealer Bond Cost?

The bond cost is based on the personal credit of the dealer (soft check), their years in business and dealership's practices. For the common $50,000 Retail Dealer Bond, rates start at $175 for one year or $18 monthly. Additional bond limits and their starting rates are shown in the chart:

| Dealer Type | Bond Limit | Monthly | 1 Year | 2 Years |

|---|---|---|---|---|

| Motor Vehicle Dealer | $50,000 | $18 | $175 | $307 |

| Wholesale, Auction, Salvage, RV | $25,000 | N/A | $150 | $263 |

| Moped/Motorcycle | $5,000 | $10 | $100 | $175 |

Lessors also need a surety bond when they will be listed as the lessor on the title of vehicles sold. The minimum bond amount for Lessors is $60,000.

The monthly option gives you more financial flexibility in the beginning and makes it so you don’t have to worry about bond renewal, as long as payments continue to go through. The annual and multi-year plans offer a discounted rate for paying at the time of issuance. For renewal, Jet will send you an email link where you can simply input payment information.

Why are Licensed Wisconsin Dealers Required to Hold a Surety Bond?

The Wisconsin Auto Dealer Bond guarantees compensation to any aggrieved persons that have lost money as the result of a dealer’s failure to comply with state laws. The surety bond is just one regulation in place to protect Wisconsin’s citizens.

Failing to follow the laws set forth in Wisconsin Statutes, Chapter 218 will result in fines, penalties, license suspension or revocation, or a bond claim. Claims occur for things such as odometer tampering and failing to deliver a title with the sale of a vehicle.

Get Your Wisconsin Motor Vehicle Dealer Bond in Minutes

Filling in some basic business information, such as your social security number (for the soft credit check) and business phone number and address, will get you through the application within 5 minutes. Click the button to get started.

After all required information has been put in, you’ll be quoted with monthly, annual, and multi-year payment options; choose your preferred term and enter your credit card information to get instant access to your bond form.

Jet will file the bond for you, free of charge, but if you prefer to do so yourself, use the address below to file any paperwork.

Wisconsin Department of Transportation

Dealers Section

PO Box 7909

Madison, WI 53707

Email [email protected] for any questions regarding bond renewal or cancellation. Once we notify the Department of Transportation of cancellation, the bond will remain on file for 60 days before being cancelled.

Read About Dealer Bond Claims and Bond Handling With Jet

Wisconsin Dealer Bond Form Example