Pennsylvania Administrator Bond

Estate administration – also known as “probate” – is the legal process of collecting the assets and property of someone who has passed away, paying off debts, and distributing those assets to the heirs. The Register of Wills in the decedent’s county appoints a personal representative or administrator to settle the decedent’s affairs in probate.

Pennsylvania Statute 3171 requires most administrators to post a surety bond before being appointed. This bond protects the estate's beneficiaries and creditors, ensuring that the administrator faithfully performs their fiduciary duties according to law.

Have any questions? Give us a call at (855) 470-0877 and speak to a live Pennsylvania probate bond expert.

What is the Required Bond Amount?

Pennsylvania Statute 3171 grants the Register the authority to determine the required bond amount on a case-by-case basis depending on the personal property value of the estate. Some counties may require a bond as high as double the amount of the estate assets.

Petitioners must file the bond with their petition to open the estate and can confirm with the Register if a bond is required in their case at the time of filing. The Register may adjust the required bond amount under PA Statue 3173 if the value of the estate assets changes during the probate process.

How Much Does a Pennsylvania Administrator Bond Cost?

The Pennsylvania Administrator Bond costs a minimum of just $85 per year, with the specific cost varying depending on the bond amount. Apply online in minutes or call one of our probate bond experts at (855) 470-0877 to find out exactly how much your bond will cost.

To determine how much the bond will cost, administrators can follow the steps listed below:

- Determine the Required Bond Amount

The Register of Will determines the bond amount based on the total amount of the estate, excluding any real estate, that the fiduciary has to oversee.

- Calculate the Total Cost

Jet Surety charges $85 per year for all administrator bonds up to $17,000 in size. For each additional $1,000 increase in the bond amount, the bond premium will increase by the corresponding amount outlined in the table below. See the chart below to calculate the price for larger bonds.

| Bond Amount | Additional Premium (per $1,000) | Bond Cost (1 year) |

|---|---|---|

| $0 - $17,000 | $85 flat rate | $85 |

| $17,001 - $50,000 | $5.00 | $85 - $250 |

| $50,001 - $200,000 | $3.75 | $250 - $813 |

| $200,001 - $500,000 | $2.50 | $813 - $1,563 |

| $500,001 - $1,500,000 | $1.00 | $1,563 - $2,063 |

| $1,500,000+ | $0.50 | $2,063+ |

Jet does not require credit checks for applicants with bond sizes under $25,000 or under $50,000 if the applicant has retained an attorney. Pennsylvania Statute 3537 allows administrators to be reimbursed for the bond premium as an estate expense.

Call us at (855) 470-0877 for an estimate of how much your probate bond will cost.

What is the Process of Becoming an Administrator in Pennsylvania?

Step 1 – Hire an Attorney

Although not explicitly required, it is highly recommended that administrators hire an attorney to assist with probating an estate. Jet Surety provides free recommendations for lawyers in our Attorney Partner network.

Step 2 – Purchase a Surety Bond

Unless otherwise exempt, administrators must purchase and maintain a surety bond (exemptions outlined below).

Step 3 – File the Required Documents

The Register of Wills requires the following items to be submitted when filing to open an estate:

- Petition for Grant of Letters

- Original last will and testament (if applicable)

- Copy of death certificate

- Check or cash for probate fees

The petition must include basic information about the deceased person, the nominated administrator, and the estate’s assets and heirs. The petition must be filed where the decedent lived or owned property, and a surety bond covering the value of estate assets must accompany the petition. Once the Register of Wills grants the petition for probate, the administrator will be issued a Short Certificate, which grants them the authority to act on behalf of the estate.

What is the Purpose of a Pennsylvania Administrator Bond?

Administrators and personal representatives are responsible for managing, preserving, and distributing the deceased person’s estate. Pennsylvania Statute 3171 requires administrators to post a probate surety bond to ensure that the estate assets are managed under estate regulations and Pennsylvania law. If the fiduciary fails to fulfill their duties, the surety bond is a financial guarantee for any damaged interested party of the estate, such as an heir or creditor.

What are the Responsibilities of an Administrator in Pennsylvania?

Administrators in Pennsylvania have several key responsibilities in managing the probate process and settling the deceased person's estate. The primary duties are outlined in Title 20 of the Pennsylvania Statute and include the following:

- Gather and Inventory Assets: The administrator must locate and secure all of the decedent’s assets, including any bank accounts, real estate, and other personal property. The administrator must also file an inventory of all estate assets to the court after appointment.

- Notify Creditors and Pay Debts: Administrators must provide formal notice to any estate creditors for three consecutive weeks as required by PA Statute 3162. If there is money to pay the estate's debts, the administrator must pay the debts from the estate before making any disbursements to the heirs

- File Inheritance Tax Returns: The administrator should also determine what amount of state inheritance taxes must be paid and should consult an experienced estate attorney to ensure compliance. Inheritance tax rates vary based on the heir’s relationship to the decedent. You can find a breakdown of Pennsylvania inheritance taxes on the Department of Revenue’s website here.

- Distribute Assets to Beneficiaries or Heirs: After settling all debts, taxes, and expenses, the administrator must distribute the remaining assets to the heirs-at-law or beneficiaries following the will's provisions or intestate succession under Pennsylvania law.

- Provide Accounting: The administrator must thoroughly document all financial transactions made on behalf of the estate and file an accounting report that comprehensively summarizes the estate's income, expenses, distributions, and all other financial activities. PA Statue 3501.1 requires an accounting to be filed with the Register of Wills at least four months after the administrator is granted letters.

How is the Estate Distributed if There's No Will?

If the deceased person did not leave behind a will, the administrator must distribute assets according to intestate succession. We’ve researched how estate assets flow in these cases and provided a general overview of the distribution order below.

If the decedent is survived by:

- Children but no spouse: The children inherit everything in equal parts

- A spouse but no children or parents: The spouse inherits everything

- A spouse and shared child: The spouse inherits the first $30,000, plus 1/2 of the remaining assets and the children receive the other ½

- A spouse and a child from someone other than that spouse: The spouse inherits ½ of the estate and the children inherit the other ½ equal shares

- Spouse and parents: The spouse inherits the first $30,000, plus 1/2 of the remaining assets and the parents receive the other ½

- No children or spouse, surviving parents only: The parents receive the entire estate

- No children, spouse or parents; surviving siblings only: The siblings divide the net estate equally

Intestate succession is another example of why an effective estate plan is essential to control who receives property when one passes. We are not licensed attorneys, so we recommend consulting with an attorney or estate settlement service like Meet Alix or Trust & Will when managing an estate.

When is a Bond Not Required in Pennsylvania?

According to Pennsylvania Statue 3174, the Register of Wills may waive the surety bond requirement for administrators and personal representatives in the following situations:

- If the will explicitly waives the bond requirement and the nominated fiduciary is an in-state resident

- If the fiduciary is an in-state resident, and the sole heir to the estate or all interested persons waive the bond

- A bank and/or trust company acting as a fiduciary

The court may still require a bond for any estate administrator if they believe it necessary to protect the estate. Pennsylvania will require a surety bond for all out-of-state fiduciaries.

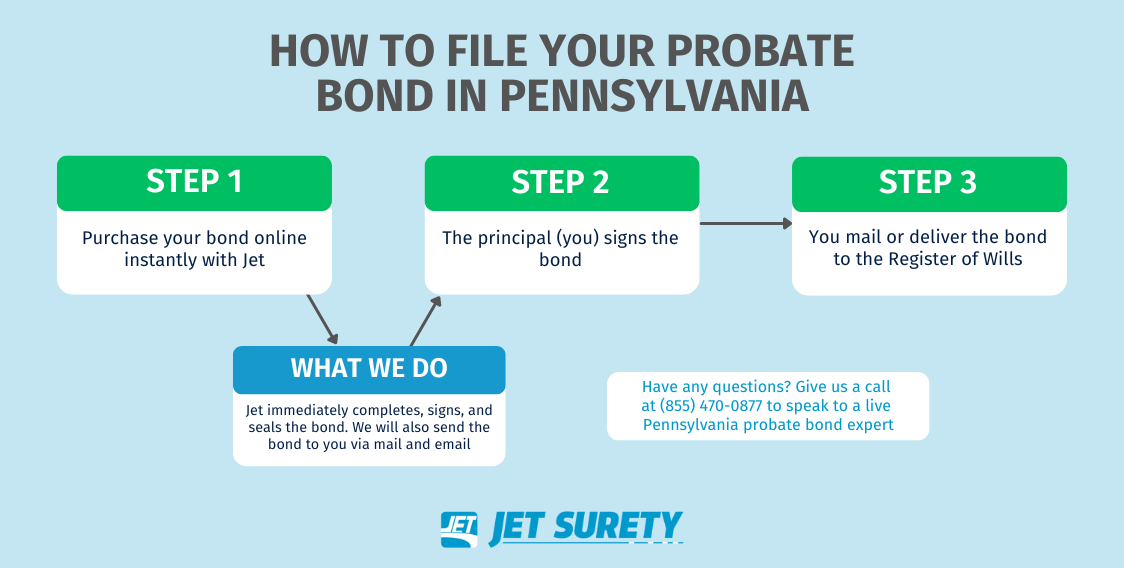

How Does the Application Process Work with Jet?

Jet’s application process is simple and fast - our goal is to get the fiduciary bonded as quickly as possible so they can focus on their obligations. All we need is the bond amount and basic information about the estate.

Once completed and submitted, you will receive your purchase price immediately, or a Jet underwriter will reach out for more information. Some of the factors Jet considers when underwriting a Pennsylvania probate bond application:

- If the applicant has ever committed a felony

- If there are disputes among the estate’s beneficiaries

- If the applicant has an attorney assisting with the estate

- Applicant’s credit history for bond limits over $25,000 if they have not retained an attorney, or $50,000 if they have retained an attorney

Applicants for bond limits over $50,000 should submit documentation from the court for review, such as a petition for appointment and the order from the court requiring the bond. If you have any questions about applying, please call our probate underwriters at (855) 470-0877.

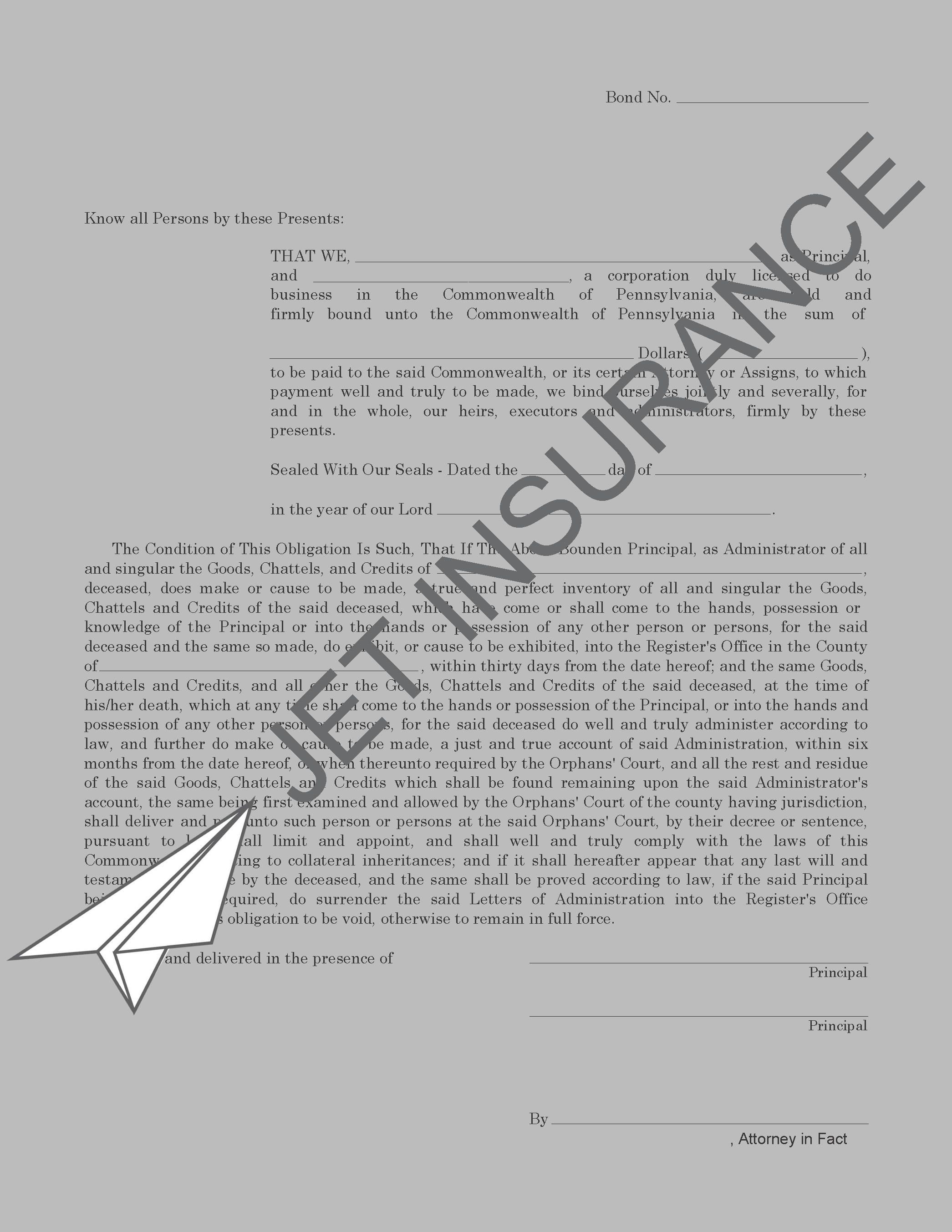

How Do You File a Pennsylvania Probate Bond with the Register of Wills?

Jet (the Surety) and the administrator must sign the original bond. Jet fills out the bond form, signs as the Surety, and sends the original bond to the administrator to sign and file the completed bond with the Register of Wills. Jet will also send the administrator an electronic copy of their bond to keep in their files.

Important Terms to Know in Pennsylvania Probate

- Administrator: A person appointed by the court to manage the estate of a person who dies with no will. Also known as a administrator of an estate.

- Beneficiary: An individual who is legally entitled to a certain portion of a decedent’s estate when there is a will.

- Decedent: The individual who has passed away and left the estate.

- Estate: All real property and personal property owned by a decedent at the time of their death.

- Executor: A person nominated in the deceased individual’s will to administer their estate.

- Fiduciary: A person in control of or with influence over another’s property. In this case, it refers to both guardians and personal representatives.

- Heir: A person who inherits assets when a person passes away with no will.

- Inheritance Tax: A tax imposed on the property passed down to an heir of an estate.

- Intestate: If the decedent dies without a will, the estate is considered Intestate.

- Personal Property: Non-movable assets in an estate, including cash, stocks, jewelry, personal effects, vehicles, etc.

- Personal Representative: In Pennsylvania, this is a catch-all term for the person in charge of settling the estate. The definition includes any executor named in a will.

- Probate: The legal process through which the representative of a deceased person’s estate is appointed by the Register of Wills to distribute property, pay all expenses and debts, and distribute net assets to the deceased person’s heirs.

- Probate Bond: A type of surety bond guarantees compensation for interested parties in a probate case if the person securing the bond (the fiduciary) fails to fulfill their duties or causes any financial harm to beneficiaries of the estate. Also known as fiduciary or estate bonds.

- Surety Bond: A type of insurance required for Pennsylvania executors and administrators that guarantees they will faithfully perform their duties to settle the estate.

- Testate: If the decedent dies with a will and the executor is named in the will, the estate is considered Testate.

- Trust: A legal document and arrangement where property is given to someone to be held for the benefit of another person.

- Will: A legal document that states a person’s wishes about how their property will be distributed after death.

How Do You Renew the Pennsylvania Administrator Bond?

Jet will notify the administrator well before the renewal date to ensure timely payment. Jet will inform the attorney (when applicable) and the Register of Wills if payment is not made. If the renewal remains unpaid, the Register will set a hearing upon being notified of failing to maintain the bond.

How Long Do You Need the Pennsylvania Administrator Bond?

The Register of Wills can release the bond once the administrator has paid all debts, distributed all assets, and provided an approved final accounting. Once the estate is settled, the administrator simply needs to email documentation to [email protected] so that we can cancel the bond and issue any applicable refund due back to the administrator. All premiums paid after the first year are subject to a prorated refund for the unused term.

How Does an Administrator or Executor Avoid Probate Bond Claims?

Administrators have a critical role in settling an estate, and any unethical action could financially damage the estate’s heirs, creditors, or the State of Pennsylvania. Anyone appointed as an administrator must adhere to all estate regulations and ensure they fulfill all responsibilities outlined in Title 20 of the Pennsylvania Statute.

Some examples of potential actions that could cause a claim:

- Committing negligence, embezzlement, or fraud

- Buying or selling any part of the estate without authorization

- Misusing or misappropriation of estate assets, such as mixing estate and personal funds

- Failing to distribute estate assets to its legal beneficiaries

- Nonpayment of any estate inheritance taxes and debts

An heir or creditor to the estate with proven financial damages caused by the administrator may file a claim against their bond. To avoid a bond claim, we highly recommend that administrators retain the services of an attorney to assist in managing the case.

What Happens if a Claim Is Filed on the Probate Bond?

Upon receiving notice of a claim on the bond, Jet has 30 days to pay the claim or ask for additional time to review it. Jet works tirelessly to protect our clients against faulty claims, so even if the Register of Wills requests a bond payout, we assess all documentation provided before paying out the claim. However, if a claim is valid and Jet pays the claimant, the administrator must pay Jet back as the representative is ultimately liable for their own actions.

Pennsylvania Register of Wills Locations

Administrators and personal representatives can find a list of all the county Register offices in the state of Pennsylvania here, along with their addresses and contact information. Fiduciaries should also contact the Self-Help Center for their specific court for guidance in getting started.