Franchise or Business Opportunity Bond Claims Guide

Estimated Read Time: 4 minutes12-22-2021

Franchise Bonds and Business Opportunity Bonds are often a license/registration requirement for individuals who run a franchise or act as sellers of a business opportunity. Governing state regulators typically require such surety bonds to financially ensure that the terms and conditions of the individual’s license will be upheld. The bond acts as a means of restitution should the franchisee owner or a person of the public sustain financial damages due to a license violation.

As a direct surety provider, Jet Insurance Company is required to pay out claims that have been deemed justified. However, one of Jet’s main goals is to protect our customers from baseless bond claims, so let's go over some license regulations and what to do should a claim occur.

What Not to Do as a Franchise or Business Opportunity Licensee

The following is not a complete list but includes the most common actions that may lead to a claim on a Franchise or Business Opportunity Bond:

- Fraud

- Misrepresenting a service and/or product

- Committing a breach of contract

- Failure to file annual reports and/or pay the franchisee (applies to franchise licensees only)

Surety Bond Claim Process

Before a Franchise or Business Opportunity Bond claim may be officially filed with the surety provider (Jet), the damaged party is typically required to first file a complaint with the regulating state entity (obligee). Generally, the licensee will be notified of the complaint and given a chance to resolve the issue.

If the matter remains unresolved, the obligee may inflict license penalties onto the franchise handler or business owner, and the damaged party has the right to pursue civil action against the licensee. In cases where civil action is taken, the state court will either make a judgment in favor of the licensee or complainant based on the evidence and testimony collected. If the licensee is found guilty, a claim may be filed upon the surety bond.

Once notification of a claim filing has been sent to Jet, our team will begin a review and investigation of the alleged license violation, and the principal (franchise handler or business owner) will be asked to provide all available information and documentation regarding the case. If we determine that the claim is valid, payment will be made to the damaged party (payouts will never exceed the bond amount).

Recovery and Indemnification

Once a claim has been approved, Jet will fulfill the payment due to the claimant. However, it is important for the bondholder to understand that the claim process has not been completed just yet. As all surety companies require, the bondholder will be expected to reimburse Jet for the claim payout that was made on their behalf.

Most people assume that surety bonds are a form of insurance, however, your bond is more like a line of credit. Once you have used any amount of the bond amount provided, it will need to be paid back. Failure to reimburse Jet for such can lead to future difficulties obtaining another surety bond in your state, specifically a Franchise or Business Opportunity Bond that will be required when you reapply for your license.

Bond Timelines

A bond claim is limited in two ways: how much may actually be paid out by the surety provider and when an official claim may be filed by the damaged party.

The dollar amount of your surety bond is how much liability is covered under the bond. Franchise Bonds and Business Opportunity Bonds are typically required to have a custom limit. The obligee (state regulator) will either provide information on what the bond limit should be or what it is based on in the state statutes, the bond form, or your licensure paperwork.

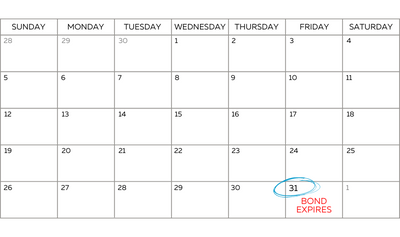

As for when a claim may be filed, this may occur at any point throughout the duration of your bond term. It is important to note that the claim window is extended when it comes to cancellation periods which range from 30, 60, or 90 days (whatever is stated on the bond form). This is due to the fact that your bond remains active during the required cancellation timeline. Once the liability period has officially ended and your bond is cancelled, claims may no longer be filed.

Regulations vary depending on the state that your franchise or business opportunity operates in, so Jet recommends thoroughly reading through the license regulations that apply to your business. The chart below includes past research completed by the Jet team on various Franchise Bonds and Business Opportunity Bonds, as well as links to legislative documents.

| Bond Information | Legislative Documents |

|---|---|

| Florida - Polk County | Polk County, Florida Municode |

| North Carolina | North Carolina Statutes |

| Texas | Texas Statutes |